Business Benefits of Accounting Process Optimization

In today's fast-paced business world, efficiency is key. Optimizing accounting processes can unlock numerous benefits for your business.

From cost savings to improved financial accuracy, the advantages are significant. Streamlined processes enhance decision-making by providing timely, accurate data.

Transitioning from cash to accrual accounting offers a clearer financial picture. It helps manage cash flow and anticipate future needs.

Automation reduces manual errors and saves time. Outsourced controller services provide expert oversight without the full-time cost.

Optimized accounting supports business growth and compliance. It enhances investor confidence with transparent, reliable reports.

Discover how accounting process optimization can transform your business. Unlock its full potential today.

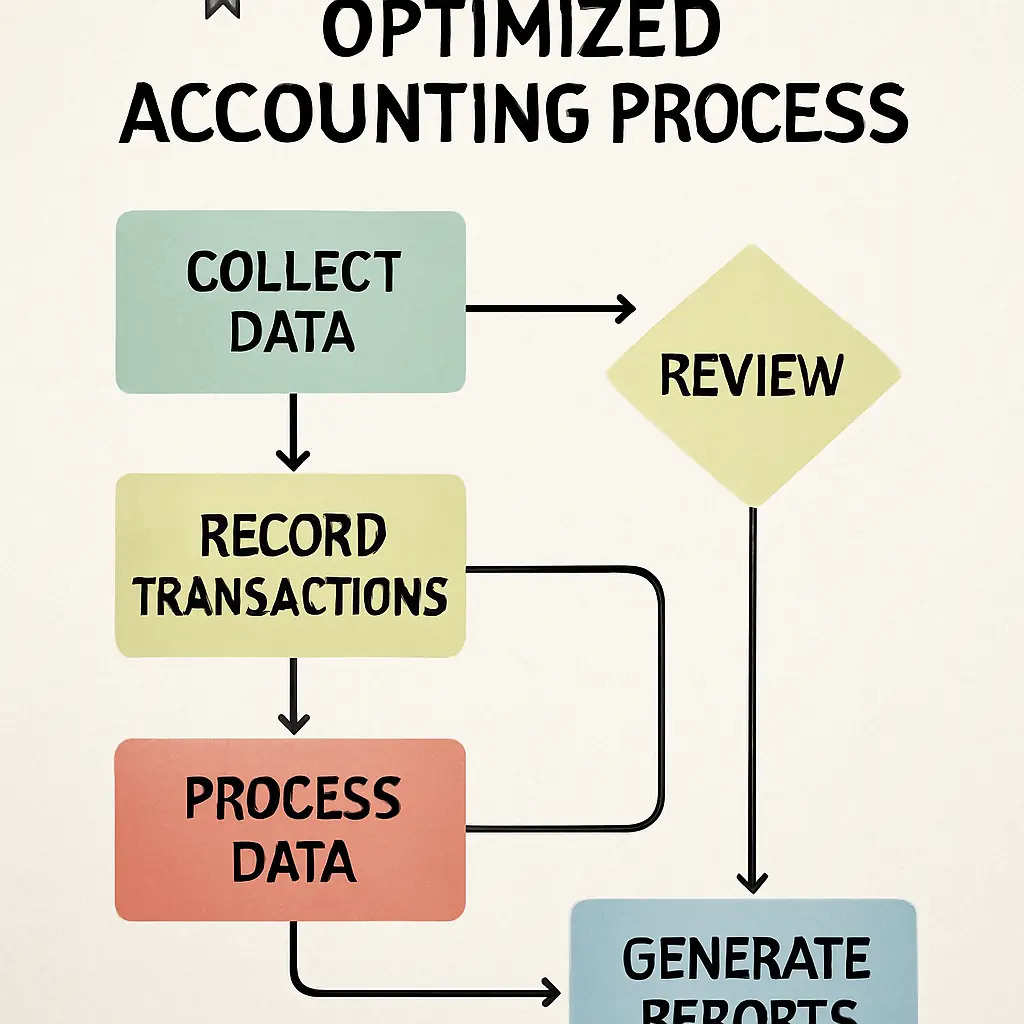

What Is Accounting Process Optimization?

Accounting process optimization involves refining financial procedures for efficiency and accuracy. It's about streamlining workflows to minimize errors and delays.

The optimization process focuses on enhancing the quality of financial data. Improved processes result in better resource allocation and decision-making.

Key elements of accounting process optimization include:

- Reducing manual tasks through automation

- Ensuring timely and accurate financial reporting

- Implementing robust internal controls

By focusing on these areas, businesses can achieve greater operational efficiency. The ultimate goal is to make accounting a strategic asset that supports business objectives and growth. Optimized processes can also reduce financial risks and enhance overall performance.

Why Optimizing Accounting Processes Matters for Your Business

Optimizing accounting processes is crucial for maintaining financial health. It ensures accurate and reliable financial data is available when needed.

With optimized processes, businesses can respond swiftly to market changes. This agility helps companies remain competitive and make informed decisions quickly.

Key benefits include:

- Enhanced decision-making capabilities

- Better resource allocation

- Improved financial reporting accuracy

Additionally, process optimization can significantly reduce operational costs. Streamlined workflows often lead to fewer errors and faster task completion.

Ultimately, optimized accounting processes support sustainable growth. They provide the financial backbone needed to achieve strategic business objectives. Accurate and timely data is vital for building investor confidence and ensuring compliance with regulations.

Key Business Benefits of Accounting Process Optimization

Optimizing accounting processes offers numerous advantages for businesses. Enhanced accuracy in reporting is a critical outcome.

Businesses with streamlined processes can achieve a detailed view of their financial health. This clarity supports strategic planning and growth.

Key benefits of optimization include:

- Detailed financial analysis

- Identification of cost-saving opportunities

- Reduced risk of errors and fraud

Automation plays a significant role in this transformation. By reducing manual tasks, businesses save time and increase productivity.

Ultimately, optimized processes foster greater transparency in financial management. They build trust with stakeholders and improve investor confidence.

A seamless accounting workflow also leads to faster financial closes. This efficiency allows companies to focus on core activities, driving long-term success.

Improved Financial Accuracy and Decision-Making

Accounting optimization enhances financial accuracy. Timely and precise data equips leaders to make better decisions.

Benefits of improved financial accuracy include:

- Reliable data for forecasting

- Enhanced strategic planning

- Reduced financial discrepancies

Accurate records ensure businesses foresee and adapt to market shifts. This adaptability is key to maintaining a competitive edge.

Enhanced Efficiency and Cost Savings

Efficiency in accounting processes translates to significant cost savings. Streamlining reduces redundancy and manual tasks.

Businesses can reap the following efficiency benefits:

- Lower administrative costs

- Faster transaction processing

- Fewer operational errors

Cost savings allow reinvestment into core business areas. This aids in scaling operations without compromising quality.

Better Compliance and Risk Management

Compliance is crucial for financial stability. Optimized processes minimize risks associated with non-compliance.

Optimization aids businesses by:

- Aligning with financial regulations

- Enhancing fraud prevention

- Managing financial risks effectively

Reduced risk strengthens business integrity. Reliable records serve as a defense against potential audits and legal challenges.

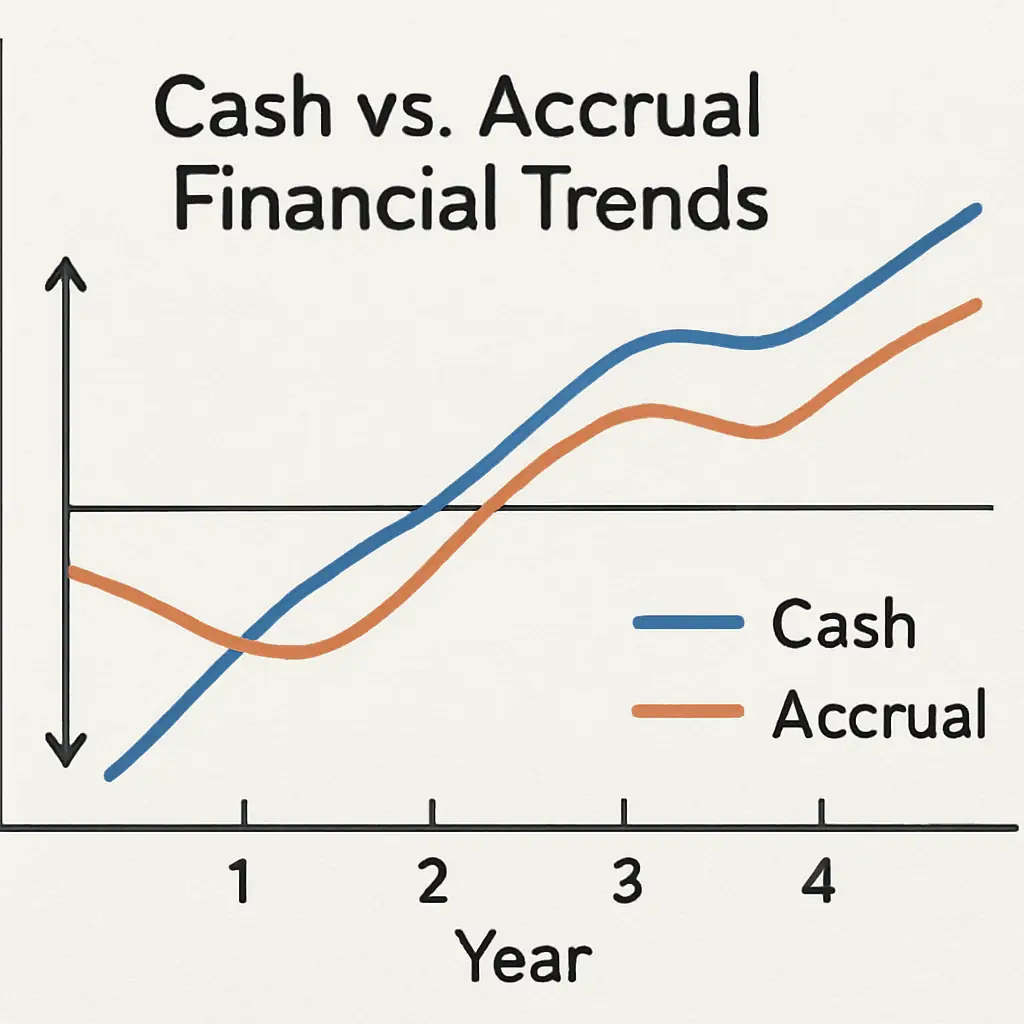

Cash to Accrual Conversion Benefits

Transitioning from cash to accrual accounting offers substantial benefits for businesses. Accrual accounting provides a more comprehensive view of financial health.

This method allows for better financial forecasting. Companies can anticipate cash flow needs and plan accordingly.

Benefits of cash to accrual conversion include:

- Improved financial accuracy

- Enhanced financial reporting

- Better strategic planning

Businesses aligning their financial reporting with industry standards gain credibility. This alignment increases investor confidence and supports growth.

Moreover, accrual accounting aids in smoothing out cash flow fluctuations. It provides a truer picture of financial stability.

Why Switch from Cash to Accrual Accounting?

Switching to accrual accounting delivers clearer financial insights. It improves tracking of revenues and expenses over time.

Key reasons for conversion include:

- Accurate profit measurement

- Improved cash flow management

- Enhanced financial compliance

Accrual accounting is essential for scaling operations effectively. It prepares businesses for greater financial responsibilities.

How Accrual Accounting Supports Business Growth

Accrual accounting facilitates strategic decision-making. It enables businesses to predict future financial outcomes with greater precision.

Benefits supporting growth include:

- Better budgeting and forecasting

- Informed investment decisions

- Enhanced financial control

Businesses can align operational and financial goals efficiently. This alignment fosters sustained growth and competitive advantage.

The Role of Automation in Accounting Process Optimization

Automation plays a pivotal role in optimizing accounting processes. By reducing manual tasks, businesses can save time and minimize errors.

Integrating automated systems enhances data accuracy. Automated tools offer real-time insights, aiding in quick decision-making.

Key benefits of automation in accounting include:

- Time efficiency

- Error reduction

- Enhanced data accuracy

Moreover, automation supports scalable financial operations. Businesses can grow without the burden of increasing manual workload.

Incorporating automation reduces administrative burdens. This allows financial professionals to focus on strategic initiatives.

Popular Tools and Technologies for Automation

Various tools simplify the accounting automation process. These technologies revolutionize efficiency and productivity.

Prominent options include:

- Cloud-based accounting software

- Robotic process automation (RPA)

- AI-driven financial analytics

Cloud software allows easy access to financial data. RPA automates repetitive financial tasks, while AI provides predictive insights. This combination enhances overall financial management.

Is Outsourced Controller Services Right for My Business?

Deciding whether to outsource controller services involves weighing benefits against your business needs. These services offer financial expertise without the cost of a full-time hire.

For small and medium businesses, this can be a cost-effective solution. Access to seasoned financial professionals enhances strategic guidance.

Consider the following scenarios where outsourcing may benefit you:

- Need for expert financial insight

- Limited internal resources for financial management

- Rapid business growth requiring financial scalability

Outsourcing can streamline financial operations, freeing up resources for core business activities. It also keeps businesses updated with the latest financial regulations.

Key Advantages of Outsourced Controller Services

Outsourced controller services provide various advantages tailored to business requirements. They bring specialized financial knowledge and industry experience.

Notable benefits include:

- Cost savings over full-time employment

- Advanced technological resources

- Flexibility and scalability in operations

These services adapt to changing business needs, facilitating growth. With expert insights, businesses can enhance their financial strategy and planning.

When to Consider Outsourcing Your Controller Function

Outsourcing may be viable if your business faces certain conditions. Evaluate your current resources and growth objectives.

Consider outsourcing in cases such as:

- Lack of internal financial expertise

- Increased complexity in financial reporting

- Need for advanced financial oversight

If financial demands outpace your internal capabilities, outsourcing offers an effective alternative. This ensures your business remains financially agile and responsive.

Steps to Start Optimizing Your Accounting Processes

Initiating the optimization of your accounting processes requires thoughtful planning and execution. Begin by evaluating your current systems and identifying inefficiencies. This helps in pinpointing areas for improvement.

Involve your team in the planning phase to ensure buy-in and gather valuable insights. Consider technological upgrades that can automate repetitive tasks and reduce errors.

Follow these steps to optimize your accounting:

- Conduct a thorough process audit

- Implement automation tools where possible

- Train staff on new processes and technologies

Regularly review and refine processes to maintain efficiency. Optimization should be an ongoing effort, adapting to changes in business dynamics.

Common Challenges and How to Overcome Them

Optimizing accounting processes presents various challenges. Resistance to change from staff is common. Address this by clearly communicating benefits and providing adequate training.

Typical challenges include:

- Staff resistance to new systems

- Initial implementation costs

Overcome these hurdles by outlining long-term benefits and offering support. Ensuring smooth transitions can help manage both costs and staff apprehension effectively.

Real-World Examples of Accounting Process Optimization

Many businesses have successfully optimized their accounting processes, leading to substantial improvements. Consider a midsize retailer that streamlined its inventory management system. By automating inventory tracking, the company reduced errors and improved financial accuracy significantly.

Another example is a manufacturing firm that adopted cloud-based accounting software. This switch allowed real-time access to financial data, enhancing decision-making capabilities and operational efficiency.

Key improvements from these examples include:

- Enhanced financial accuracy

- Improved access to data

- Streamlined operations

These real-world examples illustrate how optimization can drive tangible business benefits. They serve as a testament to the potential gains achievable through careful accounting process refinement.

Conclusion: Unlocking the Full Potential of Your Business Through Accounting Optimization

Optimizing accounting processes helps businesses achieve their full potential. Enhanced accuracy and efficiency pave the way for informed strategic decisions.

By adopting accrual accounting and leveraging automation, businesses can unlock new growth opportunities and improve financial health.

Considering outsourced controller services might also enhance your financial oversight. A streamlined accounting process ultimately supports long-term business success.

Does your business need accounting process optimization? We help businesses of all sizes, in all industries including healthcare, professional services, tech industry, nonprofit organizations, real estate firms, & more. Reach out to us today!